It’s estimated that about 12.2% of adults living in the United States do not have health insurance. Since there is an estimated 250-million individuals over the age of 18 living in the United States, this roughly equates to over 30 million adults living without health insurance. If you have multiple insurance plans, consider yourself very lucky.

How does someone end up being covered under multiple health insurance plans?

There can be various reasons why this can occur. For example, a student under the age of 26 may be covered under an employer plan as well as their parents’ plan. A student may also be covered under their parents’ plan but decide to purchase the student health insurance plan because the benefits are more robust and include the student health center as an in-network provider.

Having multiple insurance plans does not mean that claims get paid twice. One insurance will be considered primary, and this plan will pay based on the benefits outlined in the plan policy. It is possible that the secondary insurance has more comprehensive benefits, for example, the secondary has a co-insurance of 100% and the primary has 80%. In this scenario, the secondary will pay the difference of the co-insurance amounts up to the total they are required to pay per the plan policy, which in the case of the example above would be 20%.

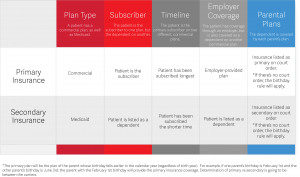

How is it decided which insurance will be considered primary?

Coordination of benefits, according to healthcare.gov, can be defined as, “A way to figure out who pays first when two or more health insurance plans are responsible for paying the same medical claim.” This will depend on the type of insurance and the plan provider.

Below is a handy guide to determining who pays first.

Disclaimer: These are basic guidelines utilized by insurance companies to determine primary vs secondary insurance. The ultimate determination will be made by the insurance carriers.